It’s getting more expensive to fuel up your car, and that’s just the tip of the iceberg. Due to the Russia-Ukraine crisis, households will feel the pinch of higher energy prices in their household budgets in the coming months.

Russia’s invasion of Ukraine early Thursday may have occurred halfway around the world, but it produced an immediate impact on consumers, with energy prices surging at levels not seen since 2014.

In the weeks leading up to the attack ordered by Russian President Vladimir Putin, President Joe Biden warned Americans that coming economic sanctions against Russia will cause “pain” here.

Here are four charts that explain Russia’s unique position in the energy market, and how it affects Europe and the United States.

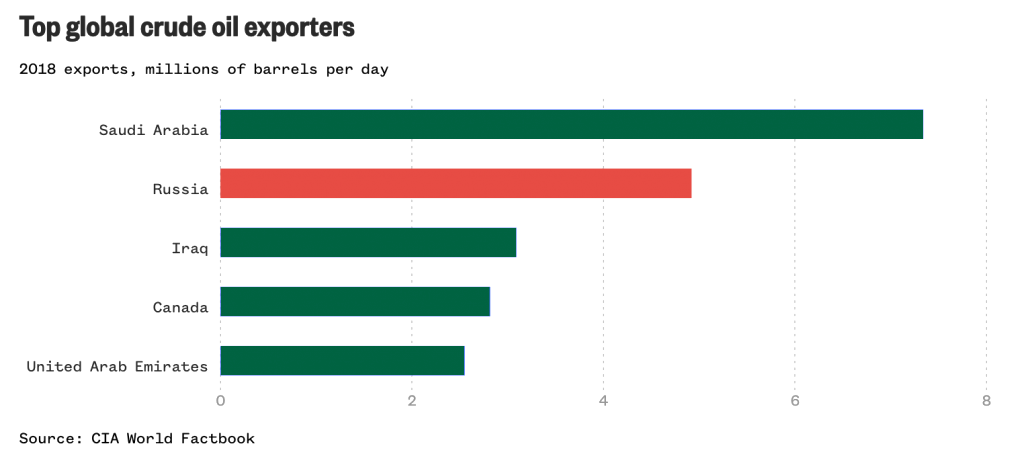

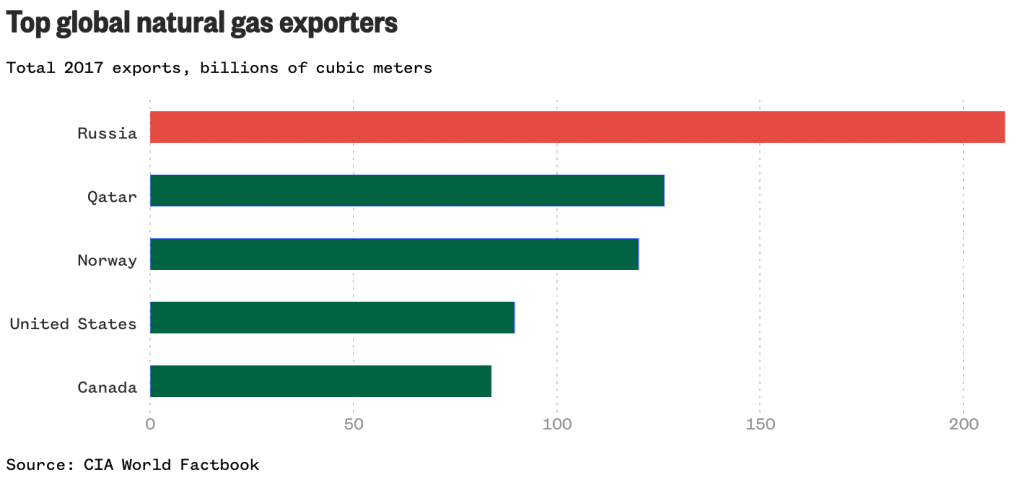

Russia is one of the biggest suppliers of energy in the world. According to data from the CIA World Factbook, it is the second-largest exporter of crude oil on the planet, after Saudi Arabia. It is also the largest exporter of natural gas, far ahead of second-place Qatar.

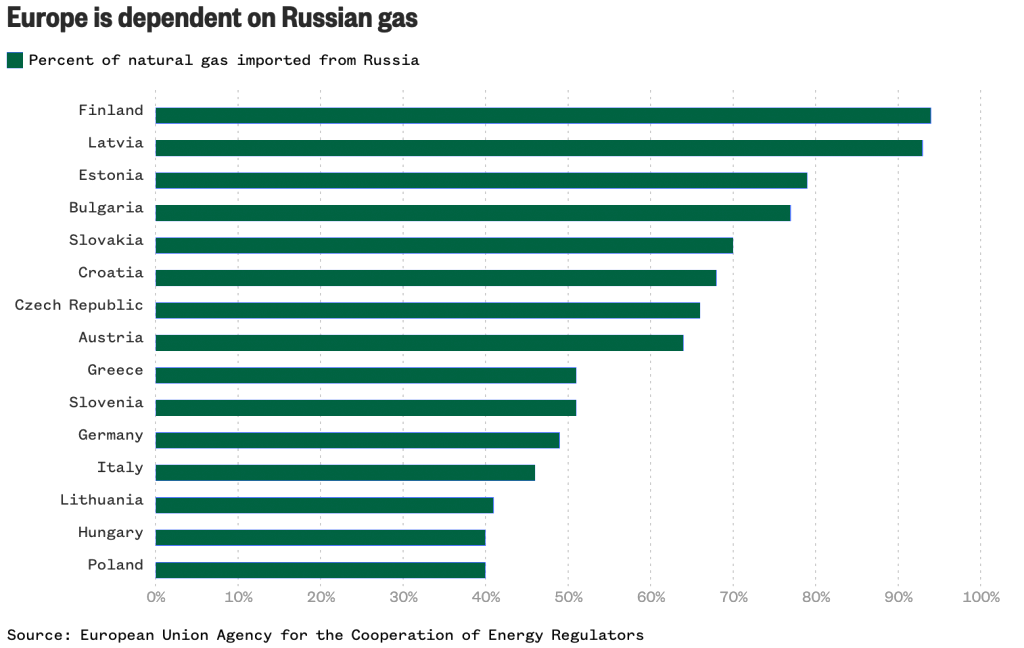

Russia’s position as a top supplier means that many nations in the European Union are reliant on it for energy. As many as 10 E.U. nations import more than half of their natural gas from Russia, with Finland, Latvia, Estonia, and Bulgaria importing more than three-quarters of their totals.

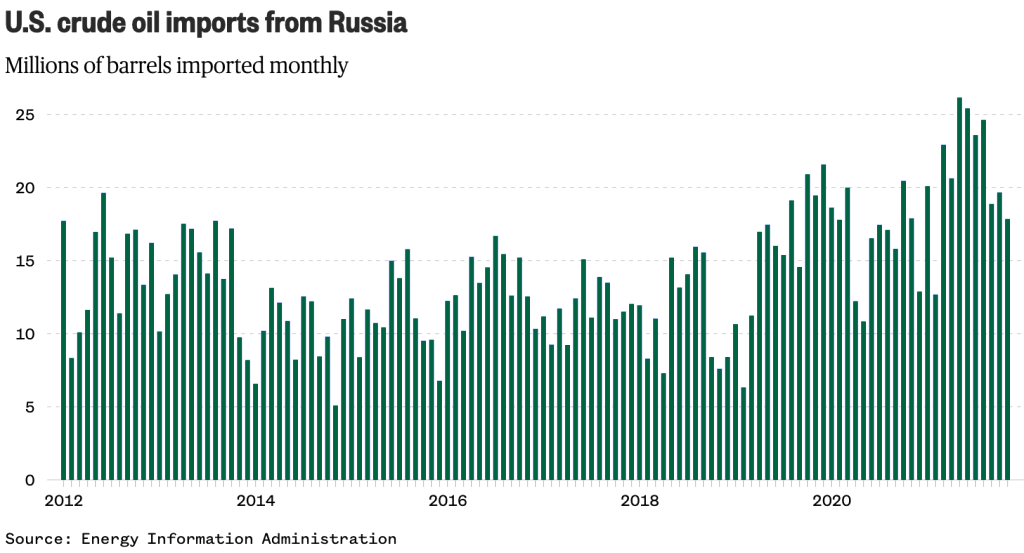

The United States is also a large importer of Russian energy. It imports tens of millions of barrels of crude oil from Russia every month, with imports topping at 26 million barrels in May 2021.

The sheer size of Russia’s energy market means that changes in its exports or production have the potential to shake global prices.

The world is already dealing with higher fuel and energy prices, in part due to supply chain issues caused by slowdowns in production at the outset of the Covid pandemic in 2020. Experts have said that any further decrease in supply, which could happen if Russia slowed exports to retaliate for sanctions, could set off a global scramble for replacements that would drive prices higher.